30 Year Mortgage Refinance Rates Texas

Get the latest mortgage rates for purchase or refinance from.

30 year mortgage refinance rates texas. Rates are updated daily. The loan to worth proportion is considered an essential indication of the riskiness of a mortgage. Compare 30 year mortgage rates and choose your preferred lender. Select product to see detail.

Learn more about today s mortgage rates. It s fast free and anonymous. Use annual percentage rate apr which includes fees and costs to compare rates across lenders rates and apr below may include up to 50 in discount points as an upfront cost to borrowers and assume no cash out. Check out our other mortgage and refinance tools lenders.

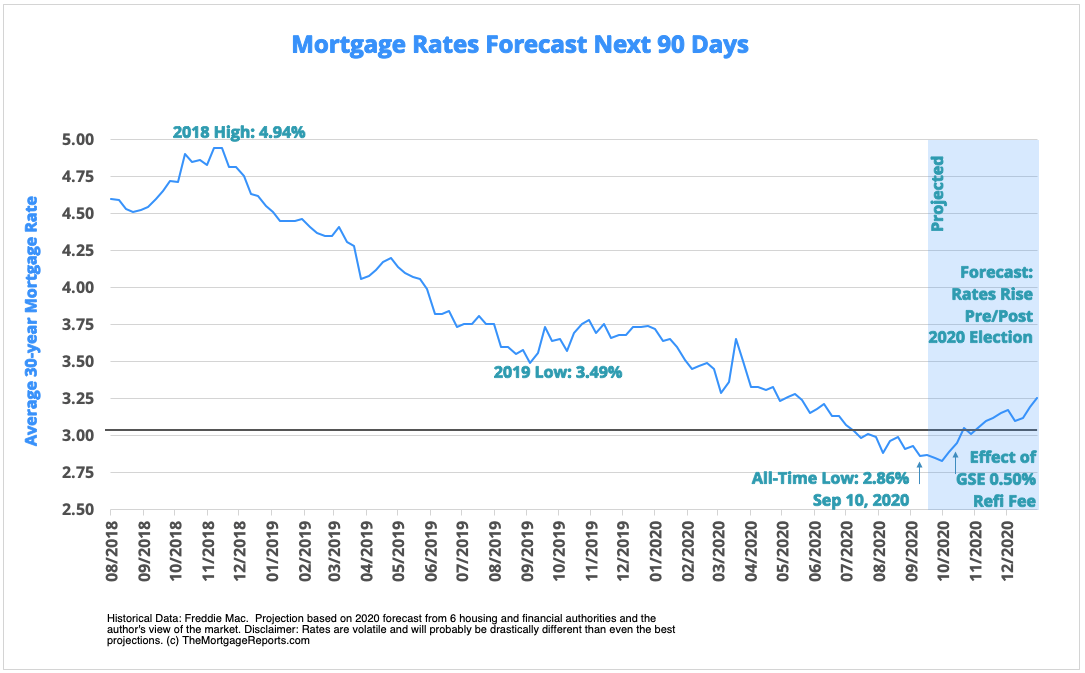

Current mortgage rates in texas are 2 95 for a 30 year fixed loan 2 47 for a 15 year fixed loan and 2 83 for a 5 1 arm. On sunday october 04 2020 according to bankrate s latest survey of the nation s largest refinance lenders the benchmark 30 year fixed refinance rate is 3 040 with an apr of 3 170. Lenders are taking on more risk by extending a rate for three decades so 30 year loans carry higher interest rates than 15 year loans. Longer terms have slightly higher mortgage rates overall.

The higher the ltv the greater the risk that the worth of the building in case of foreclosure will certainly want to cover the remaining principal of the loan. Current rates in texas are 2 99 for a 30 year fixed 2 707 for a 15 year fixed and 3 116 for a 5 1 adjustable rate mortgage arm. Current rates in texas are 3 06 for a 30 year fixed 2 55 for a 15 year fixed and 2 88 for a 5 1 adjustable rate mortgage arm. Select from popular programs like the 30 year fixed 15 year fixed 5 1 arm or other programs and we list the top offers from numerous lenders for you.

Check rates today to learn more about the latest 30 year mortgage rates. Use our compare home mortgage loans calculator for rates customized to your specific home financing need.